From the vogue dominating the runways of Paris to the streetwear of Seoul, global fashion trends have long inspired Indians, so much so that what catches on abroad often finds its way into the Indian wardrobe.

Brands like Zara and H&M have long shaped how Indians dress.

Something is changing. The brands that would command the obsession of millennials for fashion are now seemingly losing their influence, thanks to hyper-online Gen Z consumers who are driven by social media trends and expect fashion to arrive faster, cost less, and be delivered straight to their doorsteps.

Now, with rising Gen Z spending, brands have started to shift their focus to Gen Z demands. This has brought the spotlight on fast fashion, an industry . According to Redseer, while India’s overall fashion market grew at a modest 6% YoY in FY24, fast fashion surged by 30–40%.

Spotting a massive whitespace, Sumit Jasoria, the founder of three-year-old startup NEWME, saw an opportunity to build a brand that could rival the likes of Zara and H&M. But, there was one condition — Jasoria wanted his brand to outdo everyone in the race to be faster, trendier and affordable.

“Gen Z customers want trend-first designs, but they can’t afford Zara as many are still students in the early stages of their careers. So, the idea was, how do we bring trends faster than Zara, at one-third the price? There were brands on Myntra, too, but not a separate platform for all fast fashion needs. Finding something that really clicked with this audience had yet to be figured out,” Jasoria told Inc42.

He thought that launching such a platform just for Gen Z women was the need of the hour, leading to the birth of .

Launched in June 2022 by Jasoria, along with Vinod Naik, Shivam Tripathi and Himanshu Chaudhary, Bengaluru-based NEWME is a fashion brand focussed on Gen Z consumers.

The startup releases 500+ fresh, trend-led designs every week and currently has 12,000+ styles live on its platform. It launches new collections every Friday. The platform enjoys a user base of 7 Mn+ customers.

Backed by investors like Accel Partners and Fireside Ventures, NEWME has raised . The brand has over 14 retail stores, which are spread across Bengaluru, Hyderabad, Indore, Delhi NCR, Pune, Mumbai and Chandigarh.

Just seven months ago, the startup entered the quick commerce space with 90-minute deliveries in Delhi. The startup has recently also launched NEWME Zip to offer over 1,500 styles in under 60 minutes across Bengaluru.

NEWME Zip is supported by a network of dark stores, zonal hubs and a real-time inventory engine to keep the right styles stocked near high-demand areas. In early trials, the founders claim to have consistently delivered in under 30 minutes, even during peak traffic hours.

This Gen Z-focussed brand claims to have crossed the INR 180 Cr mark in just three years and is well on its way to writing its next growth chapter. But its zero-to-one journey hasn’t been easy in a space cluttered with fashion brands.

So, what has been its growth playbook? Before we answer this, let’s understand how it all started.

How NEWME Found Its FootingThe spark for NEWME came during the pandemic, when Jasoria observed changes among the Indian youth. With the explosion of streaming platforms, Korean dramas especially became popular among teens.

To his surprise, his nieces (10 and 12 years old) were completely hooked on Korean dramas, which made him curious about the popularity of such shows. He discovered that K-dramas were among the most-watched content by the Gen Z audience on Netflix.

Was he looking at a disruption, given that India had yet to explore what had already caught up around the globe? Indeed.

When he started to watch K-dramas with the girls, a revelation dawned upon him. He discovered that the Gen Z audience wanted something it could closely associate with, including fashion. So, he started focussing his energy on this very market.

While the space was already filled with names like Zara, H&M and Myntra, there was nothing truly in sync with the fast-changing trends across the globe. This realisation motivated him to move ahead with his plans.

Building a tech-driven business was a natural fit for him, given his decade-long experience in scaling technology-led ventures across India and Southeast Asia.

Before founding NEWME, he was the managing director of Meero India, an AI-based photo editing tool and marketplace for photographers. Here, he was responsible for expanding the French AI-powered digital imaging company into India and the APAC region.

Earlier in his career, Jasoria was also associated with Rocket Internet, where he was responsible for managing operations for Daraz — a leading ecommerce platform in South Asia, now acquired by Alibaba.

Stars aligned, and his close friend Tripathi moved back to India in 2020, around the same time when he was exploring this prospect.

When the two friends met, Jasoria told him what was going on in his mind. The discussion continued over the next few meetings and with his two other friends, Chaudhary and Naik.

The next thing Jasoria remembers is that the quartet of friends came to the drawing board, tracing the blueprint of their Gen Z-focussed fashion brand.

However, everything finally came together in 2022, with the .

NEWME’s Early HiccupsSoon after launch, the founders had plenty to tackle — inventory challenges, faltering delivery time and data management issues. However, every little step towards addressing inefficiencies or making amends meant only one thing — their vision to defeat the Zara and H&M of the world was coming to fruition. To achieve this, they decided to keep inventory light and designs fresh.

“If you look at traditional fashion companies, they usually have just four collection drops in a year. And they carry inventory that lasts 3 to 5 months. However, for NEWME, we wanted to drop 100s of styles every single week. For this, we knew we would have to keep our inventory cycle as low as a month,” Jasoria told Inc42.

According to him, the biggest reason for the collapse of any fashion company is inventory. “Brands that manage to keep inventory low not only survive tough times but also offer more varieties and fresh designs to consumers.”

However, for this, they had to build a business that could run on a low MoQ (minimum order quantity) model, which is difficult to sustain due to factors like:

- Thin Margins: Indian consumers are price-sensitive. Therefore, selling small quantities makes it hard to achieve economies of scale, which are essential to keep costs and prices low.

- High Fulfilment Costs: Delivering small orders increases logistics and packaging costs per unit, making the unit economics unviable.

- Cash Flow Pressure: With smaller orders, businesses need to work harder and faster to hit revenue targets, putting pressure on cash flow.

- Operational Complexity: Managing inventory, warehousing, and returns for smaller orders can be operationally cumbersome and expensive.

So the founding team dug deeper to understand what the suppliers were struggling with.

“As a result, we had to create tech solutions that ensured they didn’t lose revenue just because they were producing in low volumes,” Jasoria said.

The next challenge was to convince factories and suppliers to work with an early stage startup. This was tough because the founders had not set up a brand yet. The only thing they had was a vision.

On the other hand, if there is one thing that the NEWME founders are still endeavouring to iron out is challenges on the operational side. According to Jasoria, although NEWME has enjoyed strong brand love from day one, it has struggled with delayed deliveries. Yet, the challenges weren’t strong enough to stand in its way.

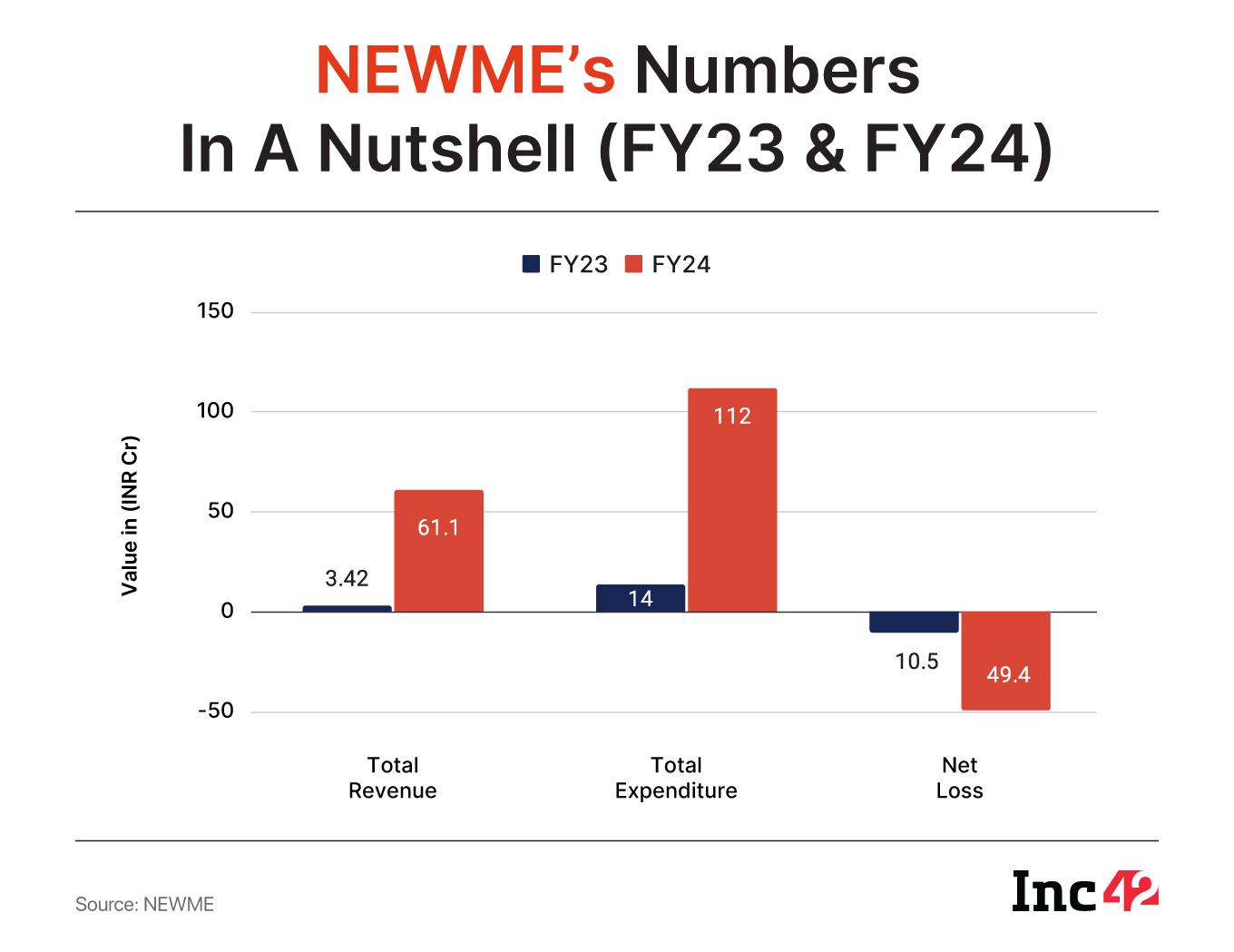

NEWME’s INR 180 Cr Top Line LeapThe brand clocked a revenue of INR 3.42 Cr in FY23 (April 2022 to March 2023), its first year of operations. Just a year later, the top line jumped nearly 18X to INR 61.1 Cr in FY24. For FY25, it claims to have already crossed INR 180 Cr in revenues (unaudited).

However, the growth has come at a cost. The startup’s losses have surged in parallel. NEWME’s net loss grew from INR 10.5 Cr in FY23 to INR 49.4 Cr in FY24 due to an increase in operational and growth-related costs. Total expenses grew more than 8X during the same period from INR 14 Cr in FY23 to INR 112 Cr in FY24.

In FY24, employee benefit expenses also more than doubled, reflecting aggressive hiring and team scale-up. A major contributor to the rising burn was the cost of inventory and the supply chain. The brand scaled logistics, packaging, warehousing and other backend operations to support its rapid growth.

While the company is still operating at a loss, the deficit has reduced significantly. “The primary focus for this year is to achieve breakeven,” the founder said, who is betting big on the strategy to run a light inventory model.

For context, the founders have built everything in-house — the supply chain ERP, demand planning systems, quality control processes, and even tech that ensures the supplier’s profit is not dented due to the MoQ model.

“Our model allows suppliers to remain profitable even when producing smaller, trend-driven batches, making it a perfect fit for the fast fashion playbook,” Jasoria said.

Currently, the brand drops 500 new styles every single week and still manages to keep inventory as light (up to 30 days).

What’s NEWME’s Play?Interestingly, according to the founders, they have always envisioned building a consumer tech startup, which NEWME currently is, along with a fashion brand.

From trend forecasting and AI-powered search on the app to a hyper-personalised demand prediction tool, the NEWME platform has it all.

“Today, 99% of what we produce is backed by data,” the founders said, adding that their tech-first approach has helped them move faster than many and understand their user base better.

Taking an omnichannel approach was another key strategy in building NEWME’s growth playbook.

In 2024 alone, the startup sharpened its arsenal with 10+ stores. It aims to open another 10 stores this year. Currently, the brand operates over 14 retail stores across metros.

“The strategy is very clear — to expand offline first. If we add ten more stores, we can almost double our revenue. At the same time, we will continue to dominate online,” the founders said.

Currently, the brand generates 23% of revenue from its offline stores and the rest from its app and website.

One of the most game-changing strategies for the brand has been its foray into quick commerce and solving the delivery experience. To make the brand what it is today, the founders knew they had to fix the delivery issues. Therefore, they built their own delivery fleet to avoid delays during peak hours.

Moving on, the company operates on a hybrid model, utilising both proprietary dark stores and those managed by external vendors. Each dark store spans around 1,500 sq ft and stocks the full live inventory of 12,000+ styles, enabling customers to shop the latest drops in under an hour.

Just eight months ago, it launched 90-minute deliveries in Delhi. Now, it has rolled out 30-60 minute delivery in Bengaluru across three hubs — HSR (covering South Bengaluru), Marathahalli, and Yelahanka.

Each of these hubs has around 10 to 12 delivery partners and extra support from external partners. When third-party services get overburdened during peak hours, the internal fleet takes charge. There’s currently no delivery fee, as the service is still in early stages.

Its inventory is powered by in-house demand planning tools, data science models, and a proprietary tech stack that ensures real-time inventory sync and rapid fulfilment.

NEWME’s Next Drop?Going forward, the brand has set its sights on becoming an INR 1,000 Cr+ brand in the next five years. The brand’s prime focus this year is to break even. For this, the founders are working on increasing gross margins and reining in operational costs.

As a first step towards this goal, it has entered the quick commerce space. The brand has already run pilots in Bengaluru and Delhi. “In Delhi, quick commerce orders now account for around 20% of total daily orders. Bengaluru’s pilot is currently around 5-6%, with plans to scale it up to 20-25% soon,” the founders said.

For the next fiscal, the founder expects a jump of 3X and aims to add 10 more offline stores this year and keep on growing the quick commerce segment in all major cities.

The brand is also looking to expand its offerings from clothes to press-on nails and perfumes for Gen Z women.

So far, the brand has made significant progress in addressing key issues like delivery delays and inventory management. However, as it scales, several challenges remain.

As of now, managing supply chain and inventory in a fast-moving, trend-driven market remains one constant challenge, which the founders are laser-focussed on addressing.

“Fabrics run out fast and the company has to secure more on short notice. Besides, factory operations can be unpredictable due to issues like labour shortages or people not showing up. These are also day-to-day operational problems that require ongoing investment and close collaboration with factory partners as the company scales,” the founders said.

Meanwhile, the brand is investing heavily in building a strong leadership team and boosting its tech capabilities. It is developing proprietary technology that supports a lean inventory model. This requires top engineering, design, and data science talent, which is costly but critical to keep pace with their fast fashion, tech-first approach.

Another critical challenge for the brand will be to lock horns with names like Shein, which has and has Reliance Retail by its side. With this, NEWME will have to tread very carefully to win in the realm of fast fashion, all while balancing rapid growth with sustainability.

In a market that is increasingly driven by Gen Z preferences, NEWME is trying to blend fashion with tech to stand out, a playbook not unique. In addition, growing losses put it in a tight spot, even though top-line expansion plans seem solid. Can it rein in its losses to become the Zara or Shein of India?

[Edited By Shishir Parasher]

The post appeared first on .

You may also like

Horses turn hazardous in Central Park as they go wild, injuring several; watch

Congress vs Congress: Shashi Tharoor hits back at 'zealots' over LoC remark, says 'I have better things to do'

After returning in IPL 2025, Tushar Deshpande backed to bring his A-game on trip to England

RBSE 5th Class Result 2025 Today: Rajasthan Board 5th result on rajshaladarpan.nic.in today, you will be able to check like this..

Brad Pitt speaks out for first time after eight-year divorce from Angelina Jolie